What is Forensic Accounting in Trust Litigation?

Forensic accounting plays a critical role in trust litigation, especially when there are concerns about financial mismanagement, fraud, or breach of fiduciary duty. Trusts are established to protect and manage assets, but disputes can arise over how these assets are handled, distributed, or reported. In such cases, forensic accounting can be a powerful tool to uncover financial discrepancies and provide clarity to courts or mediators. Here’s an overview of how forensic accounting is used in trust litigation and why it matters.

What is Forensic Accounting?

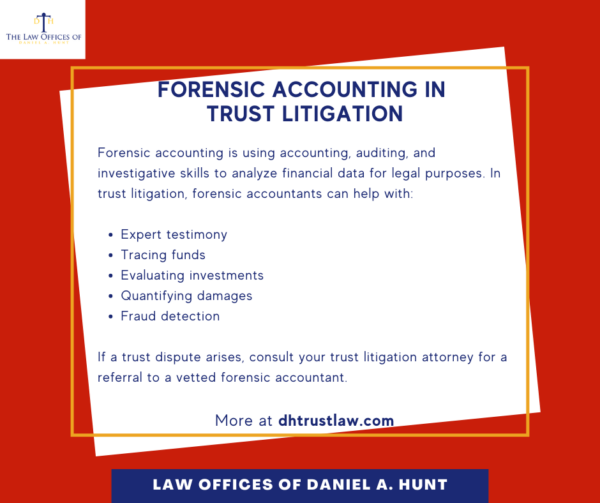

Forensic accounting involves the use of accounting, auditing, and investigative skills to analyze financial data for legal purposes. It combines financial expertise with investigative abilities, allowing accountants to trace, quantify, and explain complex financial transactions. Forensic accountants are often called upon to provide expert testimony in legal disputes involving fraud, embezzlement, or financial discrepancies.

The Role of Forensic Accounting in Trust Litigation

Trust litigation often arises when beneficiaries, trustees, or other interested parties suspect that something is amiss with the financial management of a trust. Common triggers include:

- Misappropriation of assets: A trustee may be accused of stealing or diverting funds from the trust.

- Fraudulent distributions: There could be suspicions of improper or unauthorized distributions to beneficiaries or third parties.

- Breach of fiduciary duty: Trustees have a legal obligation to act in the best interest of the beneficiaries, and any violation of this duty can lead to litigation.

- Hidden or unreported assets: There may be concerns that certain assets are not accounted for in trust statements, or that they have been deliberately hidden.

Forensic accountants in these cases analyze trust accountings, bank statements, investment records, tax filings, and other financial documents to track how trust assets were managed. Their goal is to identify any irregularities, misappropriations, or breaches of fiduciary duty.

How Forensic Accounting Helps in Trust Litigation

Forensic accounting is an essential part of trust litigation for multiple reasons.

- Expert Testimony: In trust litigation, forensic accountants often serve as expert witnesses, providing testimony based on their analysis. Their findings can provide compelling evidence that helps the court or mediator understand complex financial issues and reach a just resolution.

- Tracing Funds: Forensic accountants are skilled in following the flow of money through multiple accounts or transactions to identify discrepancies or hidden assets. In trust litigation, they can trace whether funds were diverted from their intended purpose or whether assets were improperly distributed.

- Evaluating Investments: Trust assets are often invested, and a forensic accountant can assess whether the trustee’s investment choices were appropriate and in line with the trust’s purpose. They can also determine if any conflicts of interest were present, such as investing trust assets in companies tied to the trustee.

- Quantifying Damages: If the court determines that a trustee has mismanaged or misappropriated funds, a forensic accountant can quantify the financial damage caused by the trustee’s actions. This is critical in ensuring beneficiaries are compensated for any losses.

- Fraud Detection: Forensic accountants use their expertise to uncover signs of fraud, such as forged documents, unauthorized transactions, or financial manipulation. They can also assess whether there was any collusion between the trustee and other parties in executing fraudulent transactions.

Common Scenarios Requiring Forensic Accounting in Trust Litigation

Here are some examples of situations that may require forensic accounting:

- Beneficiary disputes: If beneficiaries claim they have not received their rightful distributions or that funds have been improperly diverted, a forensic accounting may be needed.

- Disputes between co-trustees: If co-trustees are accusing each other of mismanagement or self-dealing, a forensic accountant may need to review the financial actions taken by each party.

Seek Legal Counsel

When trust-related financial issues arise, having a skilled forensic accountant involved can make all the difference in uncovering the truth and ensuring a fair outcome in litigation. If you’re involved in a trust dispute, consult with an experienced trust litigation attorney. They should be able to refer you to a trusted forensic accountant who can strengthen your case.

If you have any questions about forensic accounting in trust litigation, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.